Bank of america simple ira – Bank of America Simple IRA: Ready to ditch the ramen and embrace financial freedom? Let’s talk retirement! This isn’t your grandpa’s IRA; we’re diving deep into Bank of America’s Simple IRA offering, exploring everything from fees and investment choices to tax advantages and how to actually

-use* this thing to build a seriously awesome retirement nest egg.

Forget boring spreadsheets – we’re making retirement planning fun (yes, really!).

We’ll break down the nitty-gritty details of fees, compare it to other options, and even help you craft a killer investment strategy tailored to your needs. Think of it as your personal retirement makeover – we’re helping you unlock your future financial fabulousness. Get ready to level up your retirement game!

Bank of America Simple IRA: A Comprehensive Guide

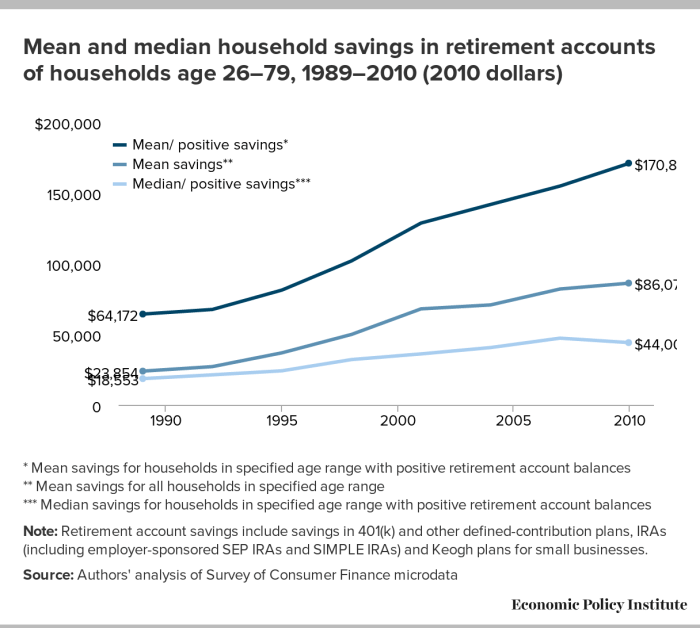

Source: epi.org

Navigating the world of retirement planning can feel daunting, but understanding the nuances of a Simple IRA, like the one offered by Bank of America, can empower you to make informed decisions for your financial future. This guide delves into the key aspects of a Bank of America Simple IRA, providing a clear understanding of its fees, investment options, account management, tax implications, and illustrative scenarios to help you visualize your retirement journey.

Bank of America Simple IRA Fees and Charges

Understanding the fee structure is crucial for maximizing your retirement savings. Bank of America Simple IRAs, like other retirement accounts, may incur various fees. These fees can impact your overall returns over time, so it’s essential to carefully review them.

| Fee Type | Description | Amount | Notes |

|---|---|---|---|

| Account Maintenance Fee | Annual fee for maintaining the account. | Potentially varies; check with Bank of America for current rates. | May be waived under certain conditions. |

| Transaction Fees | Fees for specific transactions, such as excessive trades or wire transfers. | Varies depending on the transaction type. | Check Bank of America’s fee schedule for details. |

| Fund Fees | Expenses charged by the underlying mutual funds or ETFs you invest in. | Varies by fund; disclosed in fund prospectuses. | These are not directly charged by Bank of America but impact your overall returns. |

Compared to other financial institutions, Bank of America’s Simple IRA fees are generally competitive, but a direct comparison requires checking current fee schedules from multiple providers. High fees can significantly erode long-term savings, potentially reducing your retirement nest egg substantially. Consider the cumulative effect of fees over decades of investing.

Investment Options within the Bank of America Simple IRA

The Bank of America Simple IRA offers a range of investment options to suit diverse risk tolerances and financial goals. Carefully selecting investments aligned with your risk profile is critical for long-term growth.

- Mutual Funds: A diversified pool of investments managed by professionals. Offer varying levels of risk and potential return.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on exchanges like stocks, offering greater flexibility and often lower expense ratios.

- Bank of America’s proprietary investment options: May include specific funds managed or offered by Bank of America.

Mutual funds generally offer diversification but may have higher expense ratios than ETFs. ETFs provide diversification and liquidity but their prices can fluctuate significantly. A young professional might consider a portfolio that balances growth potential with risk mitigation. A hypothetical portfolio could allocate 60% to growth-oriented ETFs (e.g., those tracking the S&P 500) and 40% to more conservative bond ETFs for stability.

Account Management and Accessibility Features

Bank of America provides various methods for managing your Simple IRA, ensuring convenience and accessibility.

Account management can be done online through Bank of America’s website, via their mobile app, or by phone. Contributions can be made through automatic payroll deductions or direct transfers. Withdrawals during retirement follow specific IRS guidelines and are generally subject to taxes.

- Visit the Bank of America website and locate the Simple IRA section.

- Click on “Open an Account” or a similar option.

- Provide the necessary personal and financial information.

- Choose your desired investment options.

- Review and confirm your application.

Tax Implications of a Bank of America Simple IRA

Understanding the tax implications is crucial for maximizing the benefits of a Simple IRA. These accounts offer tax advantages but also have specific rules regarding contributions and withdrawals.

Contributions are typically tax-deductible, reducing your taxable income for the year. However, withdrawals in retirement are taxed as ordinary income. This contrasts with a Roth IRA, where contributions are not tax-deductible, but withdrawals in retirement are tax-free. A traditional IRA offers tax-deductible contributions, but withdrawals are taxed in retirement. The choice between these account types depends on individual circumstances and long-term financial goals.

Illustrative Scenarios and Retirement Planning

Source: bac-assets.com

Let’s illustrate how a Bank of America Simple IRA can contribute to a comfortable retirement. These scenarios are simplified and for illustrative purposes only. Actual returns will vary.

| Year | Annual Contribution | Average Annual Return | Ending Balance |

|---|---|---|---|

| 1 | $3,000 | 7% | $3,000 |

| 10 | $3,000 | 7% | $42,000 |

| 20 | $3,000 | 7% | $102,000 |

| 30 | $3,000 | 7% | $206,000 |

This scenario shows the power of consistent contributions, even modest ones, over time. The impact of early contributions is significantly higher compared to delayed contributions due to the effect of compounding. Starting early allows your investments more time to grow exponentially.

Bank of America’s Simple IRA offers a straightforward retirement savings vehicle for individuals. However, businesses seeking promotional financing options may find alternative solutions more beneficial, such as those offered by huntington bank business promo programs. Returning to individual retirement planning, the Bank of America Simple IRA remains a viable option for those focused on personal retirement savings.

| Scenario | Annual Contribution | Start Age | Retirement Age (65) | Estimated Balance |

|---|---|---|---|---|

| Early Contributions | $3,000 | 25 | 65 | $380,000 (approx) |

| Delayed Contributions | $3,000 | 40 | 65 | $100,000 (approx) |

Even small, consistent contributions made early can have a substantial impact on long-term retirement savings. The difference in final balance is a result of the compounding effect of time.

Outcome Summary: Bank Of America Simple Ira

Source: facts.net

So, there you have it – a comprehensive look at the Bank of America Simple IRA. Building a secure retirement doesn’t have to be a scary, confusing process. With a little planning and the right tools, you can create a financial future that’s as dazzling as your Instagram feed. Remember, even small, consistent contributions can make a huge difference over time.

Start planning today, and your future self will thank you (with a luxurious vacation, maybe?).