APY Calculator CIT Bank – understanding how to maximize your returns with CIT Bank’s savings options is easier than you think! This guide unravels the mysteries of APY calculations, showing you how to use an APY calculator effectively to compare CIT Bank’s offerings against other banks. We’ll explore different account types, interest rates, and the factors influencing your potential earnings, providing you with the knowledge to make informed financial decisions.

From understanding the nuances of APY versus APR to navigating the impact of compounding and minimum balance requirements, we’ll equip you with the tools to confidently manage your savings.

We’ll delve into the practical applications of an APY calculator, providing step-by-step examples and addressing common misconceptions. Think of it as your personal financial advisor, guiding you through the process with clear explanations and real-world scenarios. By the end, you’ll be able to confidently analyze CIT Bank’s interest rates and choose the best savings account to meet your financial goals.

It’s all about making your money work harder for you, and we’re here to show you how.

Understanding the Annual Percentage Yield (APY) offered by CIT Bank requires careful consideration of various account types and their associated interest rates, as detailed in their APY calculator. This understanding is further enhanced by considering the bank’s peer-to-peer payment options; for instance, determining whether or not the bank integrates with Zelle, as explored in this resource: does cit bank have zelle.

Ultimately, a comprehensive financial assessment necessitates awareness of both APY calculations and available payment transfer mechanisms like Zelle.

CIT Bank APY Offerings and Calculator Usage

This article provides a comprehensive analysis of CIT Bank’s Annual Percentage Yield (APY) offerings, explains how APY calculators function, and demonstrates their application in estimating potential earnings from CIT Bank accounts. The analysis includes a comparison with competitor banks and explores factors influencing APY calculations.

CIT Bank’s APY Offerings

CIT Bank offers a range of accounts with varying APY rates, primarily focusing on savings accounts and money market accounts. These rates are influenced by several factors, including prevailing market interest rates, the account’s minimum balance requirements, and any promotional periods offered. Direct comparison with competitor banks requires accessing current rate information from each institution; however, generally, CIT Bank’s APY rates are competitive within the market for similar account types.

APY Rate Comparison Across CIT Bank Account Types

Source: bitcoinnews.com

The following table provides a hypothetical comparison of APY rates across different CIT Bank account types. Note that these rates are for illustrative purposes only and may not reflect current offerings. Always refer to CIT Bank’s official website for the most up-to-date information.

| Account Type | APY | Minimum Balance | Terms |

|---|---|---|---|

| High-Yield Savings | 0.03% | $1,000 | None |

| Money Market Account | 0.05% | $2,500 | None |

| Premier Savings | 0.07% | $10,000 | None |

| Promotional Savings (limited time) | 0.10% | $1,000 | 6 months |

APY Calculator Functionality

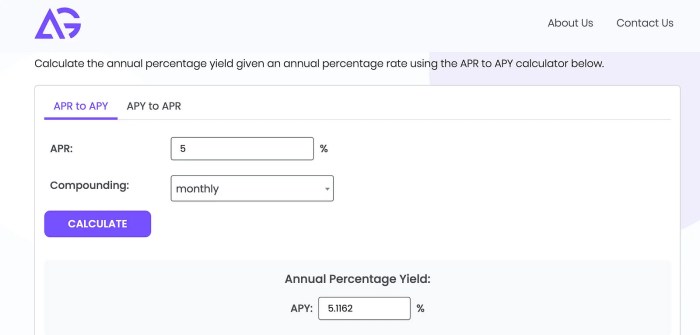

APY calculators utilize the following formula to determine the annual percentage yield: APY = (1 + r/n)^(nt)

-1, where ‘r’ is the nominal interest rate, ‘n’ is the number of times interest is compounded per year, and ‘t’ is the number of years. The calculator requires inputs such as the principal amount, interest rate, compounding frequency, and investment duration to compute the APY.

APY vs. APR

APY represents the actual annual earnings considering the effect of compounding, while APR (Annual Percentage Rate) only reflects the stated interest rate without considering compounding. For savings accounts, APY is a more accurate reflection of the return on investment.

Simplified APY Calculation Example

Let’s assume a principal amount of $1,000, an annual interest rate of 5% (0.05), compounded annually (n=1), over a period of 1 year (t=1). The APY calculation would be: APY = (1 + 0.05/1)^(1*1)

-1 = 0.05 or 5%. This demonstrates that in this simplified scenario, the APY equals the nominal interest rate because compounding occurs only once per year.

Using an APY Calculator for CIT Bank Accounts, Apy calculator cit bank

An APY calculator can be used to estimate potential earnings on various CIT Bank accounts by inputting the specific APY for the chosen account, the principal amount, and the investment period. Changes in interest rates directly impact the calculated APY, with higher rates resulting in greater earnings. However, online calculators may have limitations, such as not accounting for all fees or promotional changes.

Potential Scenarios for APY Calculator Accuracy Testing

- Testing with different principal amounts.

- Testing with varying interest rates, both within and outside promotional periods.

- Testing with different compounding frequencies (daily, monthly, annually).

- Testing with different investment periods.

Factors Affecting APY Calculations

Several factors significantly influence APY calculations. Understanding these factors is crucial for accurate estimations.

- Compounding Frequency: More frequent compounding (e.g., daily) leads to a higher APY than less frequent compounding (e.g., annually).

- Minimum Balance Requirements: Failure to maintain the minimum balance can result in a lower APY or even loss of interest benefits.

- Promotional Periods: Promotional offers with temporarily higher APYs will impact the overall yield during the promotional period.

External factors that can affect accuracy include changes in market interest rates and unforeseen fees not reflected in the calculator.

Visual Representation of APY Growth

Source: slidesharecdn.com

A graph illustrating APY growth over time for a hypothetical CIT Bank savings account would typically show an exponential curve. The steepness of the curve would depend on the APY rate; higher rates result in a steeper curve, reflecting faster growth. A comparison graph showing different CIT Bank accounts over 5 years would have time on the x-axis and account balance on the y-axis.

Each account would be represented by a separate line, with labels clearly indicating the account type and its corresponding APY.

Final Thoughts: Apy Calculator Cit Bank

Ultimately, understanding how to use an APY calculator in conjunction with CIT Bank’s offerings empowers you to make smart financial choices. By considering the factors influencing APY calculations, such as compounding frequency and minimum balance requirements, you can optimize your savings growth. Remember, it’s not just about earning interest; it’s about making informed decisions to reach your financial goals.

So, take the time to explore CIT Bank’s options, use the APY calculator effectively, and watch your savings grow! Good luck, and happy saving!