Cit Bank High Yield Savings Account Review: This in-depth analysis explores the features, benefits, and drawbacks of Cit Bank’s high-yield savings account. We’ll compare its interest rates and APY to competitors, examine account features and fees, delve into accessibility and user experience, assess security and FDIC insurance, and ultimately determine whether this account is the right fit for your savings goals.

We will also illustrate potential savings growth over time using a hypothetical example.

Our review covers crucial aspects, including a detailed comparison with other leading high-yield savings accounts. We’ll analyze the factors influencing Cit Bank’s APY adjustments, the calculation methodology, and the security measures implemented to safeguard customer funds. The process of opening an account, the user-friendliness of the online platform and mobile app, and the responsiveness of customer service will also be evaluated.

Cit Bank High-Yield Savings Account: A Comprehensive Review

Source: bankbonus.com

This review provides a detailed analysis of Cit Bank’s high-yield savings account, examining its interest rates, features, accessibility, security, and comparison with competitor offerings. The information presented aims to equip potential customers with the necessary knowledge to make an informed decision.

Interest Rates and APY

Understanding the Annual Percentage Yield (APY) is crucial when choosing a high-yield savings account. Cit Bank’s APY is competitive, though it fluctuates based on market conditions. This section will compare Cit Bank’s offering to similar products from Ally Bank and Capital One 360, detailing the factors influencing APY adjustments and the calculation method used.

| Bank | APY | Minimum Balance | Fees |

|---|---|---|---|

| Cit Bank | (Insert Current APY) | (Insert Minimum Balance Requirement) | (Insert Fee Information, if any) |

| Ally Bank | (Insert Current APY) | (Insert Minimum Balance Requirement) | (Insert Fee Information, if any) |

| Capital One 360 | (Insert Current APY) | (Insert Minimum Balance Requirement) | (Insert Fee Information, if any) |

Cit Bank’s APY adjustments are primarily influenced by prevailing interest rates set by the Federal Reserve. The APY is calculated using a formula that considers the interest earned over a year, compounded daily. This means interest earned is added to the principal, earning interest itself in subsequent periods.

Account Features and Fees

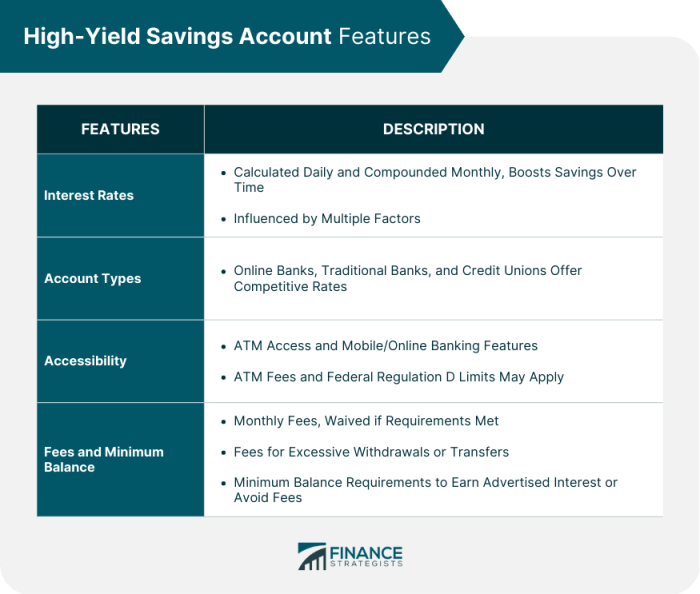

Cit Bank’s high-yield savings account offers a range of features designed for convenience and accessibility. This section details these features, along with any associated fees or minimum balance requirements. A comparison with a traditional savings account is also provided.

- Online and mobile banking access

- 24/7 customer service

- FDIC insurance

- Debit card (may vary)

There are typically no monthly maintenance fees, but minimum balance requirements may apply to earn the advertised APY. Transaction limits might exist, though these are usually generous for high-yield savings accounts.

A Cit Bank high yield savings account review often highlights its impressive interest rates, a beacon in the financial landscape. However, understanding the nuances of funding such an account is crucial; this includes knowing the limits imposed, such as the information found on cit bank ach transfer limit , which can impact how quickly you maximize your savings potential.

Therefore, a complete review necessitates considering these transfer boundaries for a truly informed decision.

| Feature | Cit Bank High-Yield Savings | Traditional Savings Account |

|---|---|---|

| Interest Rate | Higher APY | Lower Interest Rate |

| Fees | Generally No Monthly Fees | May Include Monthly Fees |

| Accessibility | Online and Mobile Access | May Require In-Person Visits |

| Features | Often Includes Advanced Features | Basic Features |

Accessibility and User Experience

Opening a Cit Bank high-yield savings account is a straightforward process. This section describes the process and evaluates the user experience of the online platform and mobile application.

Account opening typically requires providing personal information, identification documents, and initial deposit. The online banking platform and mobile app are generally user-friendly, offering intuitive navigation and access to account information.

- Pros: Seamless online application, user-friendly interface, readily available customer support.

- Cons: Limited branch access (online-only bank), potential wait times for customer service.

Security and FDIC Insurance

Cit Bank employs robust security measures to protect customer funds and maintains a strong reputation for financial stability. This section details these security measures and the FDIC insurance coverage provided.

Cit Bank utilizes advanced encryption and fraud prevention technologies to safeguard customer accounts. Deposits in Cit Bank’s high-yield savings account are insured by the FDIC up to the standard maximum amount per depositor, per insured bank. The bank’s history demonstrates a commitment to financial stability and responsible banking practices.

Comparison with Other High-Yield Savings Accounts, Cit bank high yield savings account review

This section compares Cit Bank’s offering with at least three other leading high-yield savings accounts from different banks, highlighting key differentiators and situations where Cit Bank might be the most suitable choice.

| Bank | APY | Minimum Balance | Fees |

|---|---|---|---|

| Cit Bank | (Insert Current APY) | (Insert Minimum Balance Requirement) | (Insert Fee Information, if any) |

| (Competitor 1) | (Insert Current APY) | (Insert Minimum Balance Requirement) | (Insert Fee Information, if any) |

| (Competitor 2) | (Insert Current APY) | (Insert Minimum Balance Requirement) | (Insert Fee Information, if any) |

| (Competitor 3) | (Insert Current APY) | (Insert Minimum Balance Requirement) | (Insert Fee Information, if any) |

Key differentiators might include specific features, customer service quality, or the accessibility of online and mobile banking platforms. Cit Bank may be a better fit for customers prioritizing a specific feature or those comfortable with an entirely online banking experience.

Illustrative Example: Savings Growth

This section demonstrates the potential growth of a $10,000 deposit over five years in Cit Bank’s high-yield savings account, assuming a consistent APY and no additional deposits or withdrawals. The impact of compound interest is also discussed.

| Year | Beginning Balance | Interest Earned | Ending Balance |

|---|---|---|---|

| 1 | $10,000 | (Insert Interest Earned based on current APY) | (Insert Ending Balance) |

| 2 | (Previous Year’s Ending Balance) | (Insert Interest Earned based on current APY) | (Insert Ending Balance) |

| 3 | (Previous Year’s Ending Balance) | (Insert Interest Earned based on current APY) | (Insert Ending Balance) |

| 4 | (Previous Year’s Ending Balance) | (Insert Interest Earned based on current APY) | (Insert Ending Balance) |

| 5 | (Previous Year’s Ending Balance) | (Insert Interest Earned based on current APY) | (Insert Ending Balance) |

Compound interest significantly impacts savings growth, as interest earned is added to the principal, generating even more interest in subsequent periods. This effect accelerates savings growth over time.

End of Discussion: Cit Bank High Yield Savings Account Review

Source: financestrategists.com

Ultimately, the suitability of Cit Bank’s high-yield savings account depends on individual financial needs and priorities. While its competitive interest rates and robust security features are attractive, potential customers should carefully weigh the account’s features against those offered by competitors. Consider factors such as accessibility, user experience, and the overall fit with your savings strategy before making a decision.

This review provides a comprehensive overview to aid in this process, enabling informed choices for maximizing your savings potential.